News Center

Only by enduring trials and shouldering responsibilities can one have value.

Release Date:2018-07-31 Page View:1116

According to data released by the China Automobile Association, in June, the production and sales of new energy vehicles completed 86000 and 84000 units respectively, an increase of 31.7% and 42.9% compared to the same period last year. From January to June 2018, the production and sales of new energy vehicles completed 413000 and 412000 units respectively, an increase of 94.9% and 111.5% compared to the same period last year. Among them, the production and sales of pure electric vehicles completed 314000 and 313000 units respectively, an increase of 79.0% and 96.0% compared to the same period last year; The production and sales of plug-in hybrid vehicles completed 100000 and 99000 units respectively, an increase of 170.2% and 181.6% compared to the same period last year.

From the perspective of sales trends, in February, as in previous years, sales slightly decreased due to reasons such as the Spring Festival, and since then, sales have skyrocketed. However, unlike the decline in sales that began in July of previous years, there was a slight decline in June 2018, mainly due to the implementation of the new policy after the transition period ended on June 12. The higher sales in May were also mainly due to car companies clearing inventory.

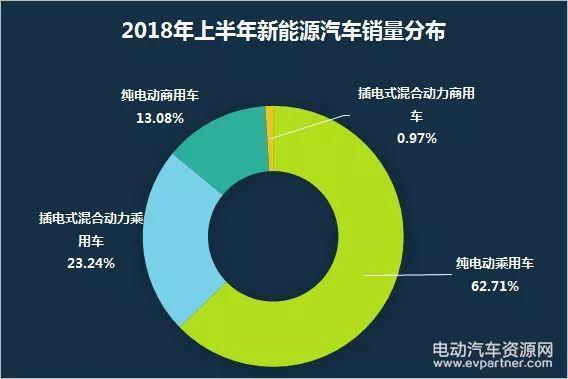

In terms of industrial structure, according to statistics from the China Automobile Association, in the first half of 2018, the sales of new energy passenger vehicles were 355000 units, including 259000 pure electric passenger vehicles and 96000 plug-in hybrid passenger vehicles; The sales volume of new energy commercial vehicles is 58000 units, including 54000 pure electric commercial vehicles and 4000 plug-in hybrid commercial vehicles.

In terms of production, in the first half of 2018, the production of new energy passenger vehicles was 355000, including 259000 pure electric passenger vehicles and 96000 plug-in hybrid passenger vehicles; The production of new energy commercial vehicles is 59000, including 55000 pure electric commercial vehicles and 4000 plug-in hybrid commercial vehicles. Overall consistent with sales.

New energy passenger vehicles: A00 level market share decreases, A0 level market share increases

According to data from manufacturers of the Passenger Transport Association, the sales of new energy passenger vehicles reached 71700 units in June 2018, a decrease of 22% month on month and a year-on-year increase of 74%. From January to June 2018, the sales of new energy passenger vehicles reached 350000 units, a year-on-year increase of 1.2 times.

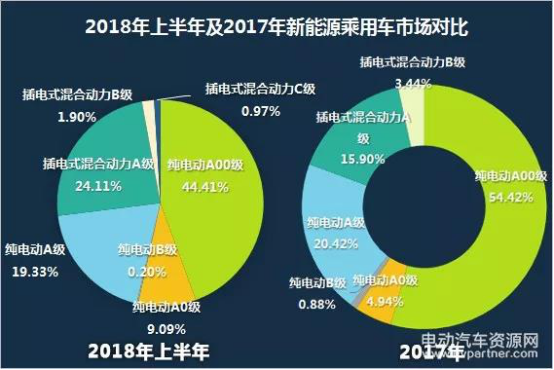

From the perspective of the new energy passenger vehicle market, the main changes are the decrease in market share of pure electric A00 class models and the increase in the pure electric A00 class market. This is mainly related to the adjustment of subsidy policies for new energy vehicles in 2018. Models with lower range will no longer receive subsidies or the subsidy will decline significantly. Most car companies are actively launching pure electric SUV products, resulting in a decrease in A00 class market share and an increase in A00 class market share.

Specifically, in the first half of 2018, a total of 156400 pure electric A00 class models were sold, accounting for 44.41% of the total, which remains the largest market. The cumulative sales of pure electric A0 class models are 32000 units, accounting for 9.09%; The cumulative sales of pure electric A-class models are 68000 units, accounting for 19.33%; A total of 713 pure electric B-class models have been sold, accounting for 0.2%; The cumulative sales of plug-in hybrid A-class vehicles are 84900 units, accounting for 24.11%; The cumulative sales of plug-in hybrid B-class vehicles are 6000 units, accounting for 1.90%. However, in the long run, the development of A00 Battery electric vehicle is a short-term trend in the new energy vehicle market. In addition, the market share of pure electric A0 class vehicles will continue to increase in 2018. It is worth noting that A00 class models with improved range by major automakers in the second half of the year will be introduced to the market. Whether they can maintain their previous market performance remains to be seen by the market.

From the cumulative sales of bicycles in the first half of this year, the BAIC EC series still ranks first with a sales record of 39903 units; BYD Qin ranked second with 22945 units sold; BYD Song ranked third, with a cumulative sales of 21201. In addition to the top 10 models, the BAIC EX series (12200), Emgrand EV (11299), and Baojun E100 (10525) also had cumulative sales exceeding 10000 units in 2018.

From the performance of car companies, in the first half of 2018, BYD ranked first with a cumulative sales volume of 71000 units; BAIC New Energy ranked second with sales of 54000 units; SAIC Passenger Cars ranks third with sales of 44000 units; Chery New Energy has sold a total of 24000 units, ranking fourth; JAC Motors ranked fifth with a cumulative sales of 20000 units. (Part of the data is quoted from publicly available data of the enterprise)

New energy logistics vehicles: Shenzhen may become the largest pure electric vehicle market

In June 2018, the sales volume of new energy vehicles in China reached 5297, including 4944 logistics vehicles, accounting for 93% of the total sales volume. The sales volume of sanitation vehicles was 350, accounting for 7%. The sales volume of other special vehicle models was relatively small, with only 3 vehicles. In the first half of 2018, the sales of new energy vehicles in China reached 20617.

From the sales trend, the trend at the beginning of the year remains consistent with previous years. From June to the end of the subsidy transition period, car companies cleared their inventory in May, resulting in a significant increase in sales of new energy specialized vehicles.

From the perspective of sales regions, in the first half of 2018, Anhui region sold the most new energy specialized vehicles, reaching 2882 units. In the first half of the year, there were also 7 provinces and cities that sold over 1000 new energy vehicles, including Guangdong, Henan, Shaanxi, Tianjin, Zhejiang, Sichuan, and Shanxi. It is worth noting that with policies such as diesel vehicle restrictions, the establishment of green logistics zones, and the introduction of subsidies for the operation of new energy logistics vehicles in Shenzhen, Shenzhen has become the forefront of the electrification of urban logistics vehicles. Therefore, it is expected that the largest new energy specialized vehicle market this year will be in Shenzhen.

In terms of corporate performance, in the first half of 2018, Shaanxi Tongjia had the highest number of new energy specialized vehicles sold, reaching 2285 units, ranking first; The second is Chery, which sold 2013 new energy vehicles in the first half of the year, ranking second; Successful cars ranked third, with 1874 new energy vehicles sold in the first half of the year. In addition, car companies with sales exceeding 1000 units include New Chufeng Automobile, Dongfeng Automobile, FAW Bus, and Ruichi Automobile.

New energy passenger cars: High growth in May, steep decline in June

In June, the sales of new energy buses reached 5686 units, a year-on-year decrease of 27.8% and a month on month decrease of 57.8% compared to May; Among them, there were 791 highways, a year-on-year decrease of 67% and a month on month decrease of 31%; 4895 buses, a year-on-year decrease of 11% and a month on month decrease of 60%.

In the first half of 2018, a total of 36651 new energy passenger cars were sold, a year-on-year increase of 156%; Among them, there were 33401 buses, a year-on-year increase of 188%, and 3250 highways, a year-on-year increase of 19.4%.

From the performance of car companies, the concentration of sales in the top 10 is 78.46%. In the first half of 2018, Yutong took the lead in selling new energy vehicles, ranking first with 8765 sales results; BYD ranks second with a total sales of 3607 units; Ranked third is Jinlv, with a total sales of 2739 units. In the first half of 2018, companies with sales of new energy buses exceeding 2000 also included Zhuhai Yinlong, Jinlong, Zhongtong, and Kaiwo Automobile.

Summary: The new energy vehicle market will continue to maintain a high-speed growth trend in 2018. In terms of passenger cars, the biggest change is the rise of A0 class models, and whether A00 class models can maintain their previous market share depends on whether the extended range A00 class models launched by car companies in the second half of this year can still capture the hearts of users. Therefore, it remains to be observed; In terms of specialized vehicles, with the encouragement of the use of pure electric logistics vehicles in various regions, especially the establishment of green logistics zones in Shenzhen, the promotion of new energy specialized vehicles will be further promoted; In terms of passenger cars, due to the strong promotion of the application of new energy vehicles in the field of public transportation, although subsidies for new energy passenger cars have significantly decreased, there is still a considerable demand for pure electric passenger cars due to the fact that most new passenger cars in various regions must be pure electric ones. But overall, the new energy vehicle market is still dancing with policies, and the trend of policies still plays a decisive role in the development trend of the new energy vehicle market. There is still a long way to go for complete marketization.